- Home (US)

- News & Events

- News

- Press Release: CTG Reports Fourth Quarter and Full Year 2020 Results

Press Release: CTG Reports Fourth Quarter and Full Year 2020 Results

Solutions Revenue Increased 22% Sequentially, Expanding to 42% of Total Revenue

Operating Margin Increased 120 Basis Points Sequentially and 90 Basis Points Year-over-Year; Highest Level in Five Years

Achieved Fourth Quarter GAAP EPS of $0.13; non-GAAP EPS of $0.14

Full Year GAAP and non-GAAP Net Income Increased 85% and 34%, Respectively

Achieved Full Year GAAP EPS of $0.53; non-GAAP EPS of $0.52

BUFFALO, N.Y., February 23, 2021 – CTG (NASDAQ: CTG), a leading provider of digital IT solutions and services in North America and Western Europe, today announced its financial results for the fourth quarter and full year ended December 31, 2020.

Fourth Quarter Financial Summary

- Total revenue increased to $101.3 million, compared with $88.6 million in the previous quarter and $99.3 million in the fourth quarter of 2019

- Solutions revenue increased to $42.8 million, or 42.2% of total revenue, compared with $35.1 million, or 39.6% of revenue, in the previous quarter, and $37.9 million, or 38.2% of revenue, last year

- GAAP operating income and margin increased $1.5 million and 120 basis points sequentially to $3.3 million and 3.3%, respectively, primarily reflecting an increased mix of Solutions revenue

- Non-GAAP operating income and margin, excluding $0.3 million in acquisition-related expenses, increased $1.2 million and 80 basis points sequentially to $3.6 million and 3.5%, respectively

- GAAP net income was $1.9 million, or $0.13 per diluted share, compared with GAAP net income of $2.8 million, or $0.20 per diluted share, in the previous quarter which included $1.1 million, or $0.08 per diluted share, in tax benefits from a change in legislation

- Non-GAAP net income was $2.1 million, or $0.14 per diluted share, compared with non-GAAP net income of $2.6 million, or $0.18 per diluted share, in the previous quarter which included $1.1 million, or $0.08 per diluted share, in tax benefits from a change in legislation

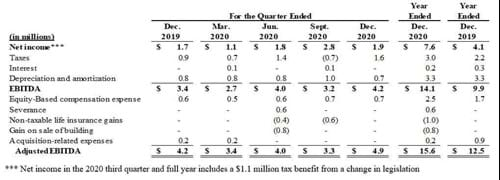

- Adjusted EBITDA increased 48.5% sequentially to $4.9 million, compared with $3.3 million in the previous quarter. Approximately 60% of adjusted EBITDA was generated from Solutions

- Cash balances totaled $32.9 million, and repaid outstanding balance on revolving line of credit facility with no long-term debt at the end of 2020

Fourth Quarter and Recent Business Highlights

- Appointed Raj Rajgopal, the former president of digital business strategy at Virtusa Corporation, to the Company’s Board of Directors in December

- Significantly expanded engagement with existing healthcare system client in the northeastern U.S. for go-live implementation and training services

- Continued to experience high utilization of billable resources resulting from low vacation and sick time, and lower levels of bench resources in European operations

- Promoted Olivier Saucin to Vice President of Global Solutions in January to lead the Company’s digital transformation growth initiatives

Full Year Financial Highlights

- Operating income increased 32.1% year-over-year to $9.1 million, primarily reflecting the increased contribution from Solutions revenue as well as higher utilization of billable resources

- GAAP net income increased 85.2% to $7.6 million, or $0.53 per diluted share, compared with $4.1 million, or $0.29 per diluted share, in 2019

- Non-GAAP net income increased 33.9% to $7.5 million, or $0.52 per diluted share, compared with $5.6 million, or $0.40 per diluted share, in 2019

- Adjusted EBITDA increased 24.8% to $15.6 million from $12.5 million in 2019

- Solutions revenue increased to 37.8% as a percent of total revenue from 35.8% in 2019

CEO Comments on Results

“Our fourth quarter results marked a strong finish to a year of exceptional financial performance, despite the challenging environment caused by the ongoing COVID-19 pandemic,” said Filip Gydé, CTG President and CEO. “Revenue increased more than 14% sequentially, driven by growth from our Solutions business, including strong momentum from our digital solutions initiatives. Revenue from Solutions expanded to more than 42% of total revenue in the fourth quarter. Combined with our robust billable utilization and the gradual disengagement from lower margin Staffing business, this Solutions growth delivered our highest operating margin in five years. For the full year, we realized significant improvement in net income, demonstrating the effectiveness of our strategic plan, excellent cost management, and our team’s disciplined execution in these difficult circumstances.”

“Underpinning the Company’s strong performance is our strategic focus on our Solutions business and the expansion of CTG’s digital transformation offerings. The team moved swiftly to deliver digital solutions to help our customers as they moved to working remotely. In support of this momentum, we are continuing to invest in sales and business development resources, enhanced solutions offerings and global delivery network capabilities, as well as the addition of talented industry leaders to our global solutions organization.”

Gydé concluded, “We are very pleased with our progress and consistent execution over the past year, which has created a solid foundation allowing us to capitalize on the substantial opportunities ahead as we seek to fulfill CTG’s vision of being a premier global solutions provider. We are committed to further accelerating CTG’s strategy, while providing our growing client base with the digital solutions they need to succeed. The CTG board and management team are confident in our ability to deliver above-market growth, increased profitability and long-term value for all CTG shareholders.”

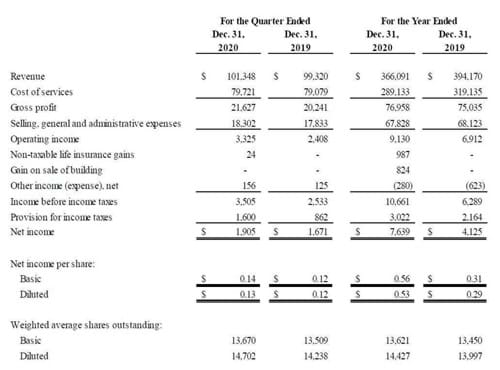

Consolidated Fourth Quarter Results

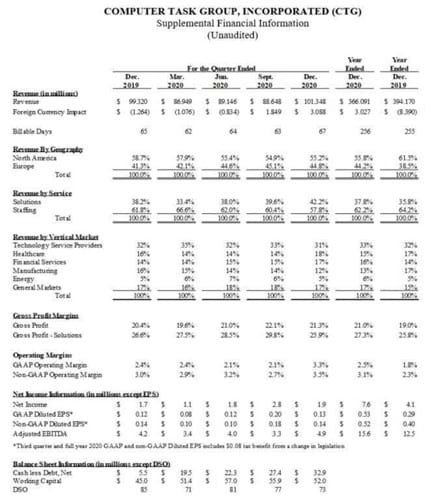

Revenue in the fourth quarter of 2020 was $101.3 million, which represents a 14.3% increase from $88.6 million in the third quarter of 2020, and a 2.0% increase from the $99.3 million in the fourth quarter of 2019. The increase in fourth quarter revenue primarily reflected the continued growth and expanded contribution from the Company’s Solutions business.

Cost of services in the fourth quarter of 2020 was $79.7 million, or 78.7% of revenue, compared with $69.1 million, or 77.9% of revenue, in the third quarter of 2020, and $79.1 million, or 79.6% of revenue, in the fourth quarter of 2019. SG&A expense in the fourth quarter of 2020 was $18.3 million, which included $0.3 million in acquisition-related expenses associated with previously acquired businesses. This compared with SG&A expense in the third quarter of 2020 of $17.7 million, which included $0.6 million in acquisition-related expenses associated with previously acquired businesses. SG&A expense in the fourth quarter of 2019 was $17.8 million, which also included $0.6 million in acquisition-related expenses.

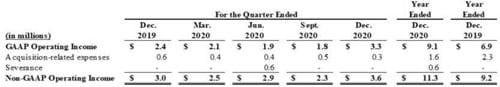

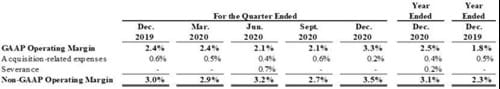

GAAP operating income in the fourth quarter of 2020 was $3.3 million, or 3.3% of revenue, and included the previously referenced acquisition-related expenses. Non-GAAP operating income in the fourth quarter of 2020 was $3.6 million or 3.5% of revenue. GAAP operating income in the third quarter of 2020 was $1.8 million, or 2.1% of revenue, and included $0.6 million in acquisition-related expenses. Non-GAAP operating income in the third quarter of 2020 was $2.4 million or 2.7% of revenue. GAAP operating income in the fourth quarter of 2019 was $2.4 million, or 2.4% of revenue, and included the previously referenced acquisition-related expenses. Non-GAAP operating income in the fourth quarter of 2019 was $3.0 million or 3.0% of revenue. CTG’s operations outside of the U.S. are conducted in local currencies. Accordingly, fluctuations in currency valuation for the countries in which the Company operates generally have minimal impact on operating results. These fluctuations increased operating income by approximately $0.2 million in the fourth quarter of 2020.

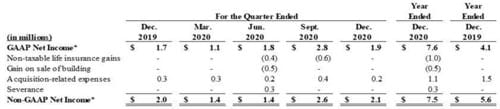

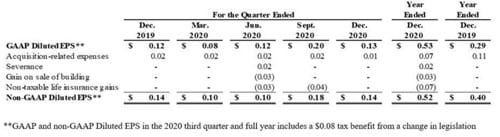

GAAP net income in the fourth quarter of 2020 was $1.9 million, or $0.13 per diluted share, which included $0.2 million of acquisition-related expenses. Non-GAAP net income was $2.1 million or $0.14 per diluted share. GAAP net income in the third quarter of 2020 was $2.8 million, or $0.20 per diluted share, which included a net $0.2 million of non-operating income, or $0.02 per diluted share, comprised of gains from non-taxable life insurance offset by acquisition-related expenses. Excluding these items, non-GAAP net income in the third quarter of 2020 was $2.6 million or $0.18 per diluted share. Additionally, both GAAP and non-GAAP net income in the third quarter of 2020 included a tax benefit of $0.08 per diluted share associated with a change in legislation during the quarter. GAAP net income in the fourth quarter of 2019 was $1.7 million, or $0.12 per diluted share, which included $0.3 million, or $0.02 per diluted share, in acquisition-related expenses, and non-GAAP net income was $2.0 million or $0.14 per diluted share.

CTG’s effective income tax rate in the fourth quarter of 2020 was 45.6% compared with a negative 31.2% in the third quarter of 2020, and 34.0% in the fourth quarter of 2019. The higher tax rate in the fourth quarter was due to certain expenses which are non-deductible for tax purposes. The negative effective tax rate in the third quarter of 2020 reflected the implementation of newly enacted legislation that allows the exclusion of certain high-taxed income resulting from the Global Intangible Low Taxed Income (GILTI) regulations. This change in legislation resulted in a tax benefit of $1.1 million, or $0.08 per diluted share, during the third quarter.

Consolidated Full Year Results

For the full year 2020, revenue was $366.1 million compared with $394.2 million in 2019. Revenue in 2020 was impacted by the challenging macro-economic conditions resulting from the COVID-19 pandemic in each of the geographies in which the Company provides services. Additionally, as part of CTG’s strategic plan, the Company continues to selectively disengage from lower margin Staffing business. Currency translation had a positive impact of $3.0 million on revenue in 2020, compared with a negative impact of $8.4 million in 2019. Cost of services in 2020 were $289.1 million, or 79.0% of revenue, compared with $319.1 million, or 81.0% of revenue, in 2019. SG&A expense in 2020 was $67.8 million, and included $1.7 million in acquisition-related expenses and $0.6 million in severance, compared with $68.1 million in 2019, which included $2.3 million in acquisition-related expenses.

Operating income for the full year 2020 was $9.1 million, which included $1.6 million in acquisition-related expenses and $0.6 million in severance. This compared with operating income of $6.9 million in 2019, which included $2.3 million of acquisition-related expenses. GAAP net income for 2020 was $7.6 million, or $0.53 per diluted share, which included a net $0.1 million of benefit, or $0.01 per diluted share, comprised of severance and acquisition-related expenses offset by gains from non-taxable life insurance and the sale of a building. This compared with GAAP net income in 2019 of $4.1 million, or $0.29 per diluted share, which included acquisition-related expenses of $0.11 per share. Operating income and net income increased year-over-year due to the increase in Solutions revenue as part of the overall business mix as it yields higher margins as compared with Staffing services.

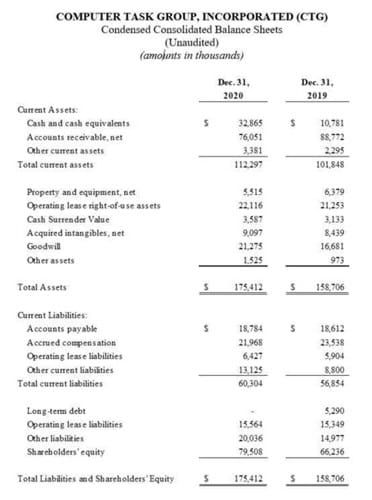

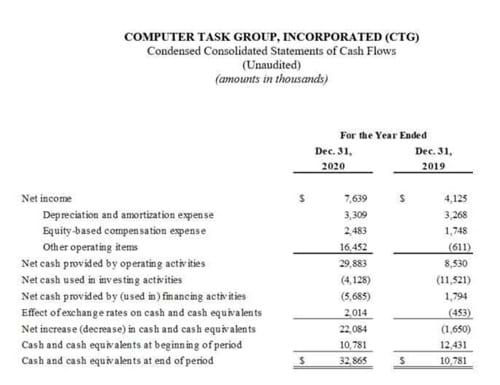

Balance Sheet

Cash and short-term investments at December 31, 2020 were $32.9 million. During the fourth quarter, the Company repaid the previously outstanding balance of $6.0 million on its revolving line of credit facility to end the year with no long-term debt. Days sales outstanding were 73 in the fourth quarter of 2020 compared with 85 in the fourth quarter of 2019.

Guidance and Outlook

Given the continued global impact of the COVID-19 pandemic and reduced visibility on CTG’s end markets and clients, the Company is not providing guidance for 2021 at this time. However, the Company expects solid revenue growth driven by a greater percentage of Solutions revenue offset by the continued disengagement from lower margin Staffing business.

John M. Laubacker, CTG Executive Vice President and Chief Financial Officer commented, “We are very pleased with the recent performance across the business and success of our strategic focus on digital solutions, which has resulted in significant increases in the Company’s margins and profitability. We remain committed to executing our strategy and investing in our global solutions organization and digital capabilities to support our objective of delivering long-term value to all CTG stakeholders.”

Conference Call and Webcast

CTG will hold a conference call today at 11:00 a.m. Eastern Time to discuss its financial results and business outlook. To access CTG’s conference call via telephone, participants should dial +1 888 251 2949 and enter the access code 9631107#. The conference call will also be available via webcast in the Investors section of CTG’s website at www.ctg.com.

A replay of the call will be available between 3:00 p.m. Eastern Time on February 23, 2021 and 12:00 a.m. Eastern Time on February 26, 2021 by dialing +1 844 585 0643. The webcast will also be archived on CTG’s website in the Events & Presentations section for at least 90 days following completion of the conference call.

About CTG

CTG is a leading provider of digital transformation solutions and services that accelerate clients’ project momentum and achievement of their desired IT and business outcomes. We have earned a reputation as a reliable, results-driven partner focused on improved data-driven decision-making, meaningful business performance improvements, new and enhanced customer experiences, and continuous innovation. CTG has operations in North America, South America, Western Europe, and India. The Company regularly posts news and other important information online at www.ctg.com.

Reconciliation of GAAP to Non-GAAP Information

The Company has referenced non-GAAP information in this news release. The Company believes that the use of non-GAAP financial information provides useful information to investors and management to gain an overall understanding of its current financial performance and prospects. In addition, non-GAAP financial measures are used by management for forecasting, facilitating ongoing operating decisions, and measuring the Company’s overall performance. The Company believes that these non-GAAP measures align closely with its internal measurement processes and are reflective of the Company’s core operating results.

A reconciliation of GAAP to non-GAAP information is included in the financial tables below. The non-GAAP financial information is presented using a consistent methodology from quarter-to-quarter and year-to-year. These measures should be considered in addition to results prepared in accordance with GAAP. In addition, these non-GAAP financial measures are not based on any comprehensive set of accounting rules or principles. The Company believes that non-GAAP financial measures have limitations in that they do not reflect all amounts associated with the Company's results of operations as determined in accordance with GAAP and that these measures should only be used to evaluate the Company's results of operations in conjunction with the corresponding GAAP financial measures. As such, the non-GAAP financial measures disclosed by the Company should not be considered a substitute for or superior to financial measures calculated in accordance with GAAP, and reconciliations between GAAP and non-GAAP financial measures included in this earnings release should be carefully evaluated.

Safe Harbor Statement

This document contains certain forward-looking statements concerning the Company's current expectations as to future growth, financial outlook, business strategy and performance expectations for 2021 and statements related to cost control, new business opportunities, financial performance, market demand, and other attributes of the Company. These statements are based upon the Company's expectations and assumptions, a review of industry reports, current business conditions in the areas where the Company does business, feedback from existing and potential new clients, a review of current and proposed legislation and governmental regulations that may affect the Company and/or its clients, and other future events or circumstances. Actual results could differ materially from the outlook guidance, expectations, and other forward-looking statements as a result of a number of factors, including among others, the effects of the COVID-19 pandemic and the regulatory, social and business responses thereto on the Company’s business, operations, employees, contractors and clients, the availability to the Company of qualified professional staff, domestic and foreign industry competition for clients and talent, increased bargaining power of large clients, the Company's ability to protect confidential client data, the partial or complete loss of the revenue the Company generates from International Business Machines Corporation (IBM), the ability to integrate businesses when acquired and retain their clients while achieving cost reduction targets, the uncertainty of clients' implementations of cost reduction projects, the effect of healthcare reform and initiatives, the mix of work between solutions and staffing, currency exchange risks, risks associated with operating in foreign jurisdictions, renegotiations, nullification, or breaches of contracts with clients, vendors, subcontractors or other parties, the change in valuation of capitalized software balances, the impact of current and future laws and government regulation, as well as repeal or modification of such, affecting the information technology (IT) solutions and staffing industry, taxes and the Company's operations in particular, industry and economic conditions, including fluctuations in demand for IT services, consolidation among the Company's competitors or clients, the need to supplement or change our IT services in response to new offerings in the industry or changes in client requirements for IT products and solutions, actions of activist shareholders, and other factors that involve risk and uncertainty including those listed in the Company's reports filed with the Securities and Exchange Commission as of the date of this document. Such forward-looking statements should be read in conjunction with the Company's disclosures set forth in the Company's Form 10-K for the year ended December 31, 2019, which is incorporated by reference, and other reports that may be filed from time to time with the Securities and Exchange Commission. The Company assumes no obligation to update the forward-looking information contained in this release.

Investors and Media:

John M. Laubacker, Chief Financial Officer

+1 716 887 7368

COMPUTER TASK GROUP, INCORPORATED (CTG)

Condensed Consolidated Statements of Income

(Unaudited)

(amounts in thousands except per share data)

COMPUTER TASK GROUP, INCORPORATED (CTG)

Condensed Consolidated Balance Sheets

(Unaudited)

(amounts in thousands)

COMPUTER TASK GROUP, INCORPORATED (CTG)

Condensed Consolidated Statements of Cash Flows

(Unaudited)

(amounts in thousands)

COMPUTER TASK GROUP, INCORPORATED (CTG)

Supplemental Financial Information

(Unaudited)

COMPUTER TASK GROUP, INCORPORATED (CTG)

(Unaudited)

The non-GAAP information below excludes gains from non-taxable life insurance and on the sale of a building, and costs associated with severance and certain acquisition-related expenses. The acquisition-related expenses consist of due diligence costs, amortization of intangible assets, and changes in the value of earn-out payments upon the achievement of certain financial targets from the Company’s recent acquisitions.

Reconciliation of GAAP to non-GAAP Operating Income

Reconciliation of GAAP to non-GAAP Operating Margin

Reconciliation of GAAP to non-GAAP Net Income

Reconciliation of GAAP to non-GAAP Diluted Earnings per Share (EPS)

COMPUTER TASK GROUP, INCORPORATED (CTG)

(Unaudited)

Reconciliation of net income to EBITDA and Adjusted EBITDA, which includes earnings before interest, taxes, depreciation and amortization, equity-based compensation, severance, non-taxable life insurance gains, a gain on a sale of a building, and acquisition-related expenses.

AUTHOR

John Laubacker

Senior Vice President and Chief Financial Officer, Americas

John Laubacker was appointed Senior Vice President and Chief Financial Officer, Americas, in December 2023, at the time that Cegeka acquired CTG. Previously, he served as CTG’s Global Executive Vice President, CFO, and Treasurer since May 2018, Senior Vice President and Chief Financial Officer since April 2017, Vice President and Treasurer since February 2017, Treasurer since 2006, and interim CFO from October 2014 to April 2015. John joined CTG in 1996.

-

News

Press Release: CTG Expands Cybersecurity Leadership and Solutions

-

News

Press Release: PeopleOne Available Within Microsoft Teams, Elevating Workplace Collaboration and Communication

-

News

Press Release: CTG Introduces Talent Solutions

-

News

Press Release: PeopleOne, Eleviant-CTG's Intranet Platform, Recognized in the 2024 ClearBox Intranet and Employee Experience Report

Let’s discuss

How CTG can help you achieve your desired business outcomes through digital transformation.

Send us a short message by completing the contact form and we’ll respond as soon as possible, or call us directly.

Looking for a job?

We’re always on the lookout for great people who share our commitment to enabling our clients’ transformations.

Social media cookies must be enabled to allow sharing over social networks.