The New Face of Hiring Risk

Remote and hybrid work models have changed how companies build their teams. What was once a necessity during the pandemic has become an essential part of the policies companies make, expanding talent pools across borders and allowing access to skilled professionals from anywhere. Yet, this shift has also opened the floodgates to new vulnerabilities. As of 2025, entirely on-site job postings have declined from 83% to 66% since 2023, while hybrid and remote options have surged.

But with great opportunity comes significant risk, like candidate fraud.

Candidate fraud includes a range of deceptive practices, from fake identities and falsified credentials to outright impersonation during remote interviews. Imagine hiring someone who aces a video call, only to discover later it was a deepfake or a proxy stand-in.

These aren't just hypotheticals; they're increasingly common pitfalls that can derail businesses.

By confirming a candidate's authenticity early, companies can avoid costly blunders and ensure their hiring pipeline remains secure and efficient.

Source: Softwarefinder.com

Understanding Candidate Fraud

Candidate fraud isn't a new phenomenon, but the rise of AI and remote hiring has supercharged it. Let's break down the standard forms:

- Identity Theft: This involves one person interviewing or working on behalf of another, often using stolen personal details. Fraudsters present themselves as legitimate remote freelancers, faking credentials and stealing identities.

- Forged Experience or Credentials: Candidates might alter pay stubs, invent job histories, or fake diplomas to meet role requirements. AI tools now make this easier, generating resumes that look perfect on paper.

- Deepfake or Proxy Interviews: Scammers use deepfakes, voice cloning, or face-swapping in video calls to bypass scrutiny. In one Reddit thread, developers shared stories of suspicious candidates who seemed "too good to be true" during virtual interviews, only for red flags to emerge later.

Statistics underscore the surge: Gartner predicts that by 2028, 1 in 4 job candidates globally will be fake. In Q2 2025, fraud insights revealed a 26% increase in suspected digital fraud for account creations, including job applications. Remote hiring scams have exploded, with FTC reports showing job scam losses jumping from $90 million in 2020 to over $501 million in 2024.

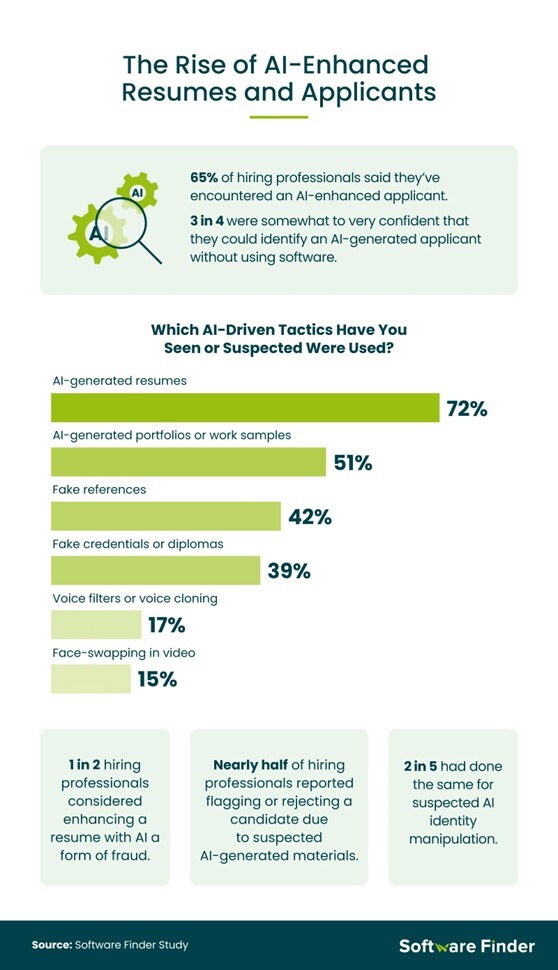

Statistics on AI-driven tactics in candidate fraud show that 72% of hiring pros encounter AI-generated resumes.

Why It's a Growing Concern for Employers

The repercussions of candidate fraud extend far beyond a bad hire. Fraud hammers productivity, as teams waste time onboarding impostors who can't deliver. Data security is at stake, too; fraudulent hires can leak sensitive information, leading to breaches that tarnish brand reputation.

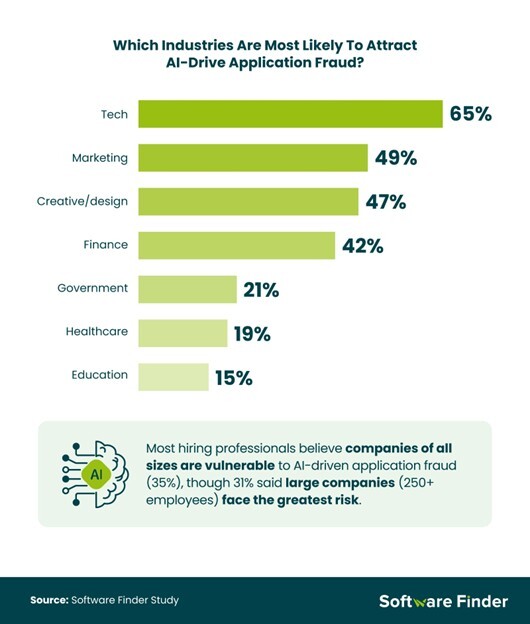

In regulated industries like finance, healthcare, and tech, compliance risks skyrocket. A single fraudulent hire could violate KYC (Know Your Customer) standards or expose companies to legal penalties.

Then there's the financial toll. Project delays compound this, with teams scrambling to re-hire while morale dips from the disruption.

Source: Softwarefinder.com

The Role of ID Verification in Modern Hiring

Digital ID verification is the frontline defense. It typically involves biometrics (such as facial

recognition), document scanning (such as passports or driver's licenses), and liveness detection to ensure the person is real and present, not a photo or a deepfake. The process starts with capturing core attributes, validating evidence against databases, and verifying linkage to a real individual.

Benefits are clear:

- Confirms Authenticity Before Onboarding: Reduces fraud by catching discrepancies early, preventing bad hires.

- Strengthens Compliance: Integrates with KYC and background checks, crucial for regulated sectors.

- Protects Remote and Global Hiring: Enables secure onboarding from anywhere, cutting delays in international talent acquisition.

Building Trust and Efficiency in the Hiring Process

Integrating ID verification doesn't have to feel invasive, and it can enhance the candidate's experience. Quick, mobile-friendly processes let applicants verify themselves in minutes, signaling a modern, secure employer. This builds trust, as candidates appreciate transparency.

Balance automation with human oversight: Use AI for initial scans but involve recruiters for nuanced reviews. Tips include starting verification after the interview, combining it with background checks, and training teams to recognize red flags such as inconsistent online presences. This hybrid approach minimizes friction while maximizing security.

Fraud Prevention as a Competitive Advantage

Partnering with experts like CTG can elevate your strategy. As a global IT solutions and staffing provider, CTG delivers talent solutions to accelerate digital initiatives, helping your staff securely and filter out fraudulent candidates through powerful processes. By partnering with such companies, you turn fraud prevention into success.